“Pay Now” Buttons

We’ve added the highly coveted “Pay Now” button to emailed invoices which enables your customers to pay online via Credit Card or ACH. When paid, A/R will be automatically updated.

Because of this automation and simplification, we’ve found on average this saves 3-5 minutes per transaction. That means if you average six transactions per day for the month, you can save an entire eight-hour day!

Print Reach Pay Features

- Add a “Pay Now” button to your website, email and invoices

- Consumer-managed ACH and credit cards

- Security and PCI compliance

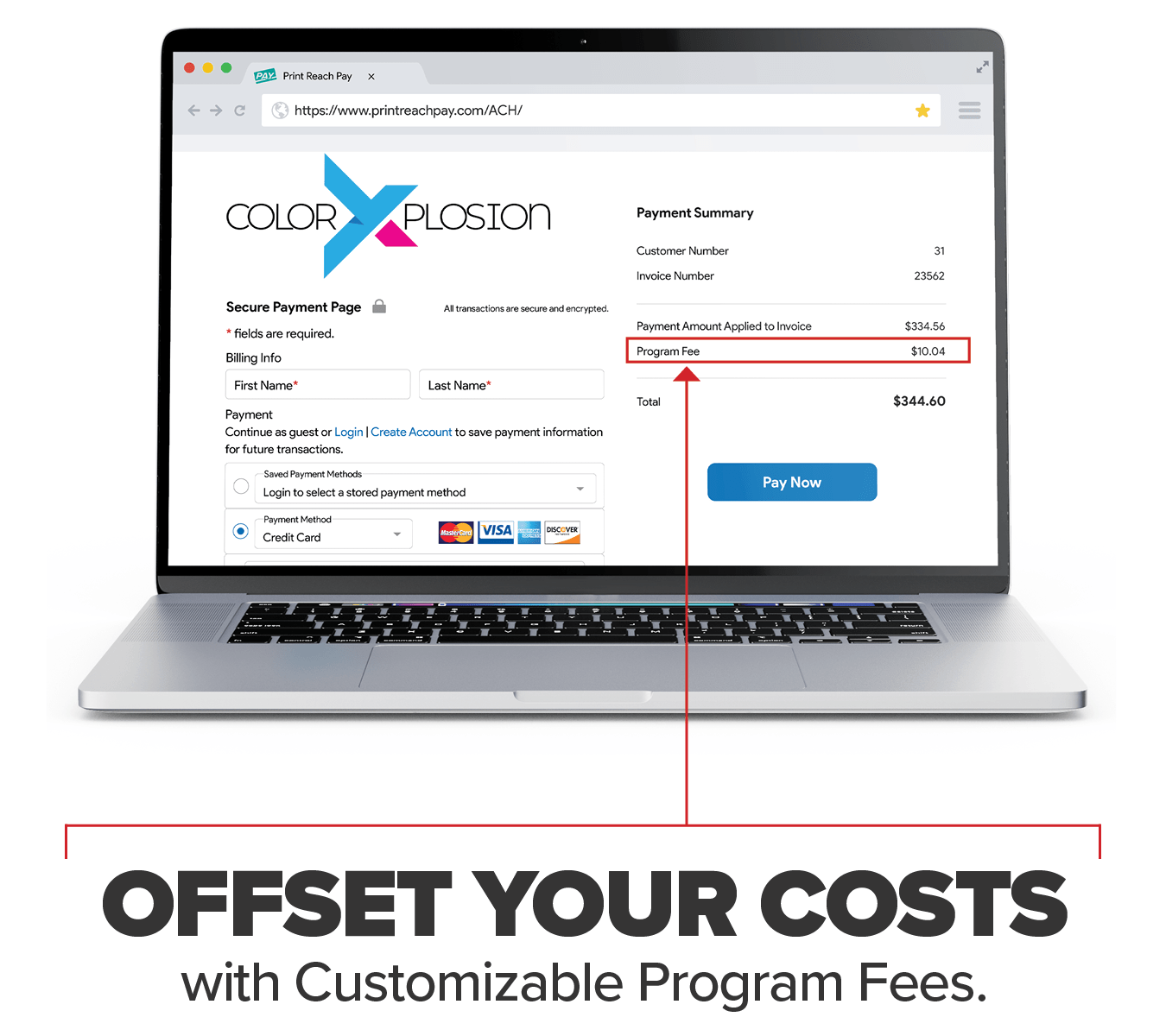

- Offset transaction costs with program fees

- One support team for both software and payments

- Support in-person and online payments

- Jobs updated with payment information in real-time

- Statements and reporting with lower fees*

*We’ve become our own Merchant Processor and now have access to the lowest possible credit card rates. We can provide the technology AND technical support for your payment needs under one roof.

“Print Reach Pay has allowed us to get paid for jobs faster with fewer internal steps. Customers like the ability to ‘pay now’ when they receive our invoices via email. There is even an online portal where clients can view and pay all of their invoices. The integrated payment process makes more sense than doing things the old manual way.”

Kessler Creative

Jacksonville, FL

Frequently Asked Questions

Q: What is Print Reach Pay?

A: When talking with customers, we found many of them were spending extra time manually entering credit card and ACH payments into their software and experiencing less-than-desirable customer support and finger-pointing with credit card companies. We became our own merchant processor and built integrated processing into our software to solve both those problems.

Q: Why should I switch to Print Reach Pay for payment processing?

A: Customers who use Print Reach Pay typically save 3-5 minutes per credit card transaction due to the simplification and automation. Because it’s integrated, we have access to the lowest possible rates and it’s rare we cannot beat your current rate. If saving time and money is important to you, then consider switching.

Q: When are the funds put into my account?

A: By default, funds are added to your account after 2 business days. ACH transaction funds typically take 5 business days to complete. Faster funding times are possible, please contact us for details.

Q: Are there fees for refunds?

A: No, we do not charge a fee for credit card refunds.

Q: Do we have to do all our payment processing through Print Reach Pay?

A: There’s no requirement to switch all your credit card charges to us, but because we’re able to beat most rates, the more you process through us the more you will save.

Q: What about walk-in customers? Can I use my existing hardware terminal?

A: Most shops use the software terminal built into the software, but some prefer an external device on the front desk. Print Reach Pay has a list of approved devices available, unfortunately, the industry does not allow us to reprogram your current device.

Q: What % rate do you charge?

A: Instead of offering a “standard” rate like PayPal, Stripe, Square, and other processors, we prefer to provide custom rates by examining your current statements. This provides you with the best pricing possible.

We want to do our very best to meet or beat your existing processing rate, but we can’t accurately assess what you’re paying today and provide an apples-to-apples quote without analyzing your current statements. We also want to uncover any “hidden fees” on your current statement.

Print Reach Pay serves our merchants through two industry-standard pricing models: Interchange Plus and Flat Rate.

With an Interchange Plus pricing model, we will pass through all Card Brand fees to you at cost. These fees are assessed by the Card Brands (Visa, Mastercard, Discover, and American Express) as well as the Brands’ card issuing banks. We will pass these fees to you at cost, with no mark-up, and then add the quoted Print Reach Pay fees per transaction. This pricing model enables you to benefit from processing cards with lower Card Brand fees, such as Debit Cards.

Flat Rate pricing is a bundled approach that includes the Card Brand fees and Print Reach Pay fees in a single rate. In this pricing model, you will pay the exact same fees per transaction, regardless of the Card Brand, Card Type or Processing Method.